Advertisement|Remove ads.

ETHZilla Jumps After Meme Trader ‘Capybara’ Discloses Major ETHZ Position, Calls Stock ‘Undervalued’

- ETHZilla shares jumped pre-market after meme-stock trader Dimitri ‘Capybara’ Semenikhin disclosed a 2.2% stake in the company.

- Capybara said ETHZilla’s $1 billion in assets and strong Ethereum exposure make it significantly undervalued.

- He cited the firm’s 10% yield, RWA tokenization plans, and backing from Peter Thiel as additional upside drivers.

ETHZilla (ETHZ) shares rallied in pre-market trade on Thursday after Dubai-based trader and real estate developer Dimitri Semenikhin, known online as ‘Capybara Stocks,’ said he had acquired 2.2% of the company.

Shares of ETHZilla — a digital asset treasury (DAT) centered on Ethereum (ETH) — rallied as much as 12.5% in pre-market trade. Retail sentiment on Stocktwits surged to ‘bullish’ from ‘extremely bearish’ territory, and chatter jumped to ‘high’ from ‘low’ levels over the past day. According to platform data, the number of traders following the stock increased 4.5% and message volume jumped more than 21% in the last 24 hours, as of Thursday morning.

Meanwhile, Ethereum’s price edged 0.3% higher in the last 24 hours, trading at around $3,800. Retail sentiment around the leading altcoin trended in ‘bearish’ territory over the past day.

Capybara’s Thesis For Buying ETHZ Shares

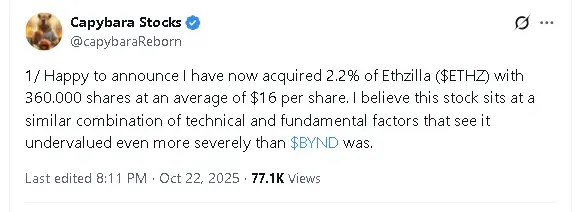

Capybara’s disclosure on X that he acquired 360,000 shares, representing 2.2% of ETHZilla at an average of $16 per share, drew attention from retail and institutional investors. He emphasized that the stock combines technical and fundamental factors that leave it “undervalued even more severely than $BYND was.”

In his ETHZilla thesis, Capybara said ETHZilla holds roughly 102,000 ETH worth $388 million, along with $550 million in cash, giving it total assets near $1 billion against a market cap of just $250 million. He said the stock trades “at half its asset value,” offering a “clear path to double.”

Capybara also noted ETHZilla's near-10% yield from deploying Ethereum across multiple protocols, outpacing other DATs that average around 3%. He added that the company recently raised $500 million in zero-interest convertible debt that converts at $31.50 per share — nearly double current levels.

He pointed to potential catalysts, including plans to enter real-world asset (RWA) tokenization and rumors of a Bitmine buyout.

ETHZilla And Beyond Meat Comparison

Capybara previously triggered a sharp rally in Beyond Meat (BYND) shares after disclosing a 4% position in the plant-based meat company. The surge pushed BYND to a one-year high following years of decline since its 2019 IPO.

His ETHZilla disclosure drew immediate comparisons to his earlier bet on Beyond Meat on Stocktwits. In both cases, the trader targeted companies he views as heavily shorted and fundamentally misunderstood by the market.

One retail trader said they don’t expect Capybara’s disclosure to have the same kind of impact as his push for Beyond Meat.

Another user predicted that traders who followed Capybara for Beyond Meat and turned a profit, are likely to buy ETHZilla’s shares as well.

ETHZilla shares have fallen 35% this month following a 10-for-1 reverse split, a move Capybara said was “misunderstood” by retail investors but necessary to attract institutional capital.

Read also: Bitcoin On Track To Hit $110,00 After China Says Trade Talks With US Set For Friday

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)