Advertisement|Remove ads.

First Solar Stock Marks Best Day In 2 Years As Wall Street Sees Positives From House Bill — Retail’s Elated

First Solar (FSLR) stock surged on Tuesday after the drafts of a U.S. tax and spending bill allayed concerns over the complete removal of tax credits for some renewable projects.

As per the House Committee on Energy and Commerce’s proposal, the tax credits for solar, wind, and geothermal projects will be phased out between 2029 and 2032.

The tax credits were part of Joe Biden’s signature Inflation Reduction Act, which Republicans, including President Donald Trump, have often attacked due to the alleged harm to automakers, miners, and fossil fuel companies.

If passed, the proposed bill would also limit imports from foreign entities of concern, like China, to prevent them from dumping solar panels into the U.S. market.

According to TheFly, Wolfe Research upgraded the stock to “Peer Perform” from “Outperform,” after noting that First Solar stands to earn $10 billion from 45X tax credits, or $92 per share.

The brokerage noted that the firm’s "domestic moat remains well intact" as the only domestic solar module manufacturer of scale. It also pointed out that the company doesn't rely on foreign components such as cells or wafers.

JP Morgan analysts noted that limiting imports from prohibited foreign-influenced entities is a "significant positive" for First Solar, as 45x credits would generate 60% of estimated earnings over the next two years.

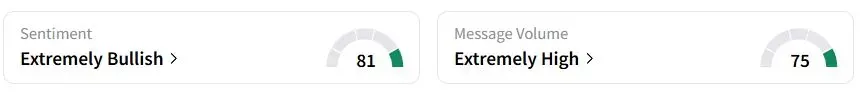

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (81/100) territory, while retail chatter was ‘extremely high.'

One bullish trader said that the stock would be over $400 within a year or two.

First Solar stock has gained 7.7% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_shopify_signage_resized_a95ee6ba6d.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)