Advertisement|Remove ads.

Palo Alto Stock’s Break Above $200 Leaves Retail Traders Hoping For Fresh Highs As Israel-Iran Tensions Fuel Cybersecurity Focus

Palo Alto Networks, Inc. (PANW) stock drew brisk retail chatter on Stocktwits, as platform users expressed optimism about cybersecurity vendors' prospects.

Palo Alto stock ended Tuesday’s session up nearly 2% at $202.05, as it reclaimed the $200 level for the first time since June 6.

The surge came after a Bloomberg report, citing the state-run Islamic Republic of Iran Broadcasting, said that Israel launched a cyberattack against Iran with the aim of disrupting services.

The message volume change for the Palo Alto stock over 24 hours until late Tuesday was 1,600%, as the stock bucked the broader market downtrend during the trading session. This marked a pick-up from the 140% change over the past seven sessions.

A bullish watcher said, “cloud security [is] back in focus.

Another user noted a strong breakout on Tuesday, adding that they had alerted about a long entry opportunity last week.

A third user braced for a “new all-time high.” The stock’s previous intraday high was $208.39, reached on Feb. 19, while its all-time closing high of $208.28 came a session earlier.

A user who was convinced of the stock’s long-term potential hoped for a pullback so that they could load more shares.

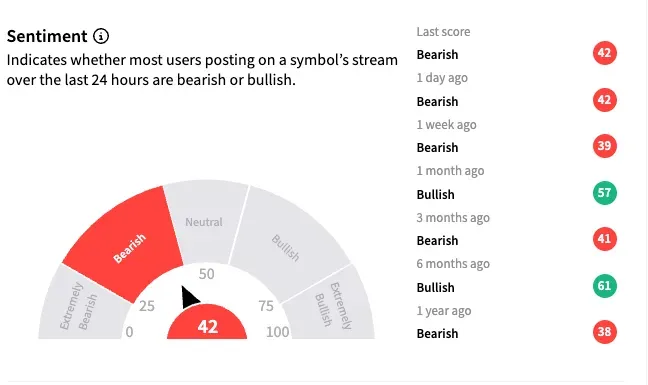

On Stocktwits, retail sentiment toward Palo Alto stock was ‘bearish’ (42/100) by early Wednesday, holding steady since last month.

Palo Alto stock moved up 0.21% in Wednesday’s early premarket session. The stock is up 11% this year.

The Koyfin-compiled average analysts’ price target for Palo Alto stock is $211.58, implying nearly 5% upside potential.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Microsoft-AMD To Partner For ‘State-Of-The-Art’ Gaming Chip To Power Next-Gen Xbox

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_shopify_signage_resized_a95ee6ba6d.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)