Advertisement|Remove ads.

SoFi Stock Hits Over 2-Year Highs, Finally Seeing 'Trump Bump' Following Upstart’s Earnings Beat

Shares of SoFi Technologies Inc. ($SOFI) surged nearly 5% on Friday, reaching $12.54 in mid-day trading — its highest point in over two years.

The stock’s climb marks the long-anticipated “Trump Bump,” driven by strong earnings from Upstart Holdings Inc. ($UPST) after the bell on Thursday.

The AI-powered lending platform also hit over two-year highs in early trading on Friday after its third quarter results. It posted $162.1 million in revenue for the third quarter, surpassing the estimated $149.3 million and reported a loss of $0.07 per share, far better than the anticipated $0.48 loss.

"Upstart is injecting jet fuel into this trade," Mizuho analyst Dan Dolev told MarketWatch.

According to him, Upstart’s results reveal that the company’s risk profile is improving, which has bolstered investor confidence in personal lenders like SoFi.

Dolev believes this shift in sentiment, alongside Trump-era policy expectations, could be pivotal for SoFi’s growth trajectory as investors grow more optimistic about the sector's potential.

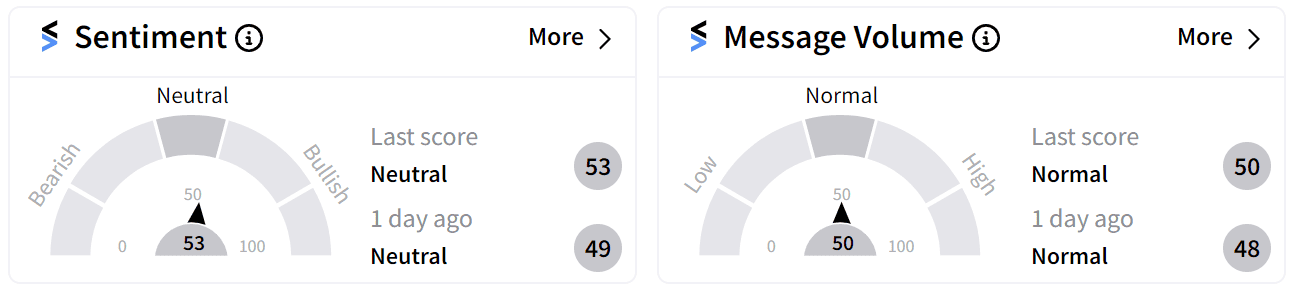

Retail sentiment around the stock remains ‘neutral’ (53/100) even as some users expect the stock to go higher before the closing bell.

Bank stocks and brokerage shares saw a sharp rally on Wednesday following Republican candidate Donald Trump’s victory in the 2024 US election, but SoFi’s stock did not rise as dramatically as many others in the sector.

According to Dolev, some investors don’t see SoFi as a “real bank” which is why it may have flown “under the radar” during the wider rally fueled by Trump’s win.

The stock has gained 30% this year so far.

For updates and corrections email newsroom@stocktwits.com.

Read also: NVIDIA Stock Rallies to Record High After Dow Entry, Retail Sentiment Cools from Peak Levels

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206312585_jpg_1a7c050dff.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_zillow_resized_34b0642476.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cars_dealership_jpg_ec0afa0631.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2023795514_jpg_88f80a65ae.webp)