Advertisement|Remove ads.

Sol-Gel Stock Tumbles Over Underwhelming Q1 Earnings: Retail Stays Pessimistic

Shares of Sol-Gel Technologies (SLGL) were in the spotlight on Friday morning after the company’s first-quarter (Q1) revenue dipped below Wall Street expectations, and losses came in wider-than-expected.

The company, which is focused on developing drugs for skin diseases, reported total revenue of $1 million in the quarter, compared to $0.5 million for the same period in 2024, but below an analyst estimate of $1.2 million, as per FinChat data.

Diluted loss per share came in at $3.2, compared to a loss of $2.3 per share for the same period in 2024, and exceeding an estimated loss of $1.2.

The company’s research and development expenses soared in the three months through the end of March by 65% year-on-year to $8.8 million.

Sol-Gel ended the quarter with $16.9 million in cash, cash equivalents, and deposits. The company expects the cash resources to fund its requirements into the first quarter of 2027.

Sol-Gel has two FDA-approved drugs—TWYNEO for treating acne vulgaris in adults and pediatric patients nine years of age and older, and EPSOLAY for treating inflammatory lesions of rosacea in adults.

The company is testing a drug candidate for the prevention of new basal cell carcinomas in Gorlin syndrome patients, and another for the treatment of rare skin keratodermas.

Earlier this month, Sol-Gel announced a reverse share split at the ratio of 10-for-1 to increase its share price and regain compliance with requirements for continued listing on the exchange.

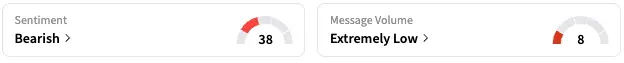

On Stocktwits, retail sentiment around Sol-Gel stayed unchanged within the ‘bearish’ territory over the past 24 hours, coupled with ‘extremely low’ message volume.

SLGL stock is down by about 25% this year and 5% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_etoro_logo_resized_jpg_e33db568c2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamieson_greer_jpg_e66ba6dd7a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2225993084_jpg_3889c04879.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259461476_jpg_bc073e334e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)