Advertisement|Remove ads.

Upstart Stock Eyes Recovery After 5-Day Losing Streak — Retail Wonders If A Short Squeeze Is Due

Shares of Upstart Holdings Inc. climbed after the closing bell on Wednesday, following a 2.8% loss in the regular session that marked a fifth straight day in the red. Retail trader sentiment, however, is holding firmly optimistic.

The artificial intelligence-based lending platform has shed 12% over the past week, while its rivals, Affirm and Klarna, have lost 11.3% and 6.3%, respectively.

According to a Jefferies analysis from earlier this week, Upstart stock short interest rose 606 basis points to 27.7% in August, the most significant jump among consumer finance companies. The report added that short interest trends "have been largely increasing over the last three months," barring the auto industry, which saw a decline in the time period.

By industry category, Jefferies analysts noted that the fintech sector saw the biggest increase in short interest, which rose 75 basis points to 11.6% in August, compared with the previous month. The report highlighted how investors might be viewing the uptick in competition in the online lending industry.

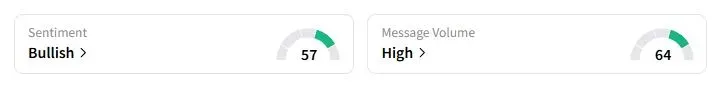

Retail sentiment on Stocktwits about Upstart remained in the ‘bullish’ territory at the time of writing, while 24-hour message volume was ‘high.’

One trader said that the stock is “coiled and ready to rocket” after noting the high short interest.

“It doesn't get much easier than this. Worst case $55. Best, this is the bottom. Either way, you are basically timing the dip buy,” another trader said.

According to Koyfin data, Upstart’s price-to-earnings ratio for the next 12 months is currently at 30.3, compared with Affirm’s 33.1. The metric is a key indicator for investors to evaluate a company's valuation.

Upstart’s AI-based lending platform helps connect borrowers with over 100 banks and credit unions. The technology enables lenders to approve more people at lower interest rates, and over 90% of loans through Upstart are processed automatically, with no human involvement.

Last month, JPMorgan analysts upgraded the stock, citing optimism about fintech lenders with more experience in the personal loan space. Upstart stock is down nearly 3% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)