Advertisement|Remove ads.

Wynn Resorts Stock Snaps 5-Day Rally: Citi Turns Less Bullish On Macau Market Share Outlook

Wynn Resorts (WYNN) shares fell marginally on Wednesday, breaking a five-day streak of gains after a rating downgrade.

Citi downgraded the stock to 'Neutral' from 'Buy.' It, however, raised its price target on the shares to $114 from $108. The new target signals a mere 3.6% upside to the current levels.

The research firm said it expects Wynn to lose market share in Macau, a key global casino hub in China. Wynn operates Wynn Macau and Wynn Palace integrated resorts in Macau, and the region reported strong gaming activity last month.

Citi added that Wynn’s "concurrent reduction in North America capex, when capex in the UAE increases, should provide Wynn with the financial flexibility to pursue new investment opportunities and enhance shareholder return."

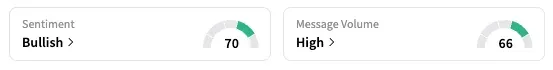

On Stocktwits, the retail sentiment shifted to 'bullish' from 'extremely bullish' the previous day. WYNN shares are down 28% year-to-date but currently trade near a 52-week high.

Wynn's property in Al Marjan Island, set to open in early 2027, will be the first-ever land-based casino resort in the Middle East. The company's international expansion has recently attracted 'Buy' ratings from Bank of America and Goldman Sachs.

Citi, however, argued that the upside is already reflected in the stock price.

The U.S. hospitality sector has demonstrated a robust post-pandemic recovery, driven by high demand for leisure and business travel, although rising operational costs and economic uncertainty pose challenges.

Wynn posted lower revenue and profit for the first quarter.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lemonade_resized_jpg_fe42e63791.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_openai_sam_altman_resized_jpg_70d64e6db7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2261646866_jpg_de6ca7bdf0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/iran_fm_iaea_chief_rafael_mariano_grossi_jpg_79ef4dc11f.webp)