Last week’s Fed decision caused an uptick in volatility, but not much directional movement in the major U.S. indexes. It’s a new week though, and market participants have decided they’re ready to sell and accept lower prices for their stocks, crypto, and other risk assets. 🙃

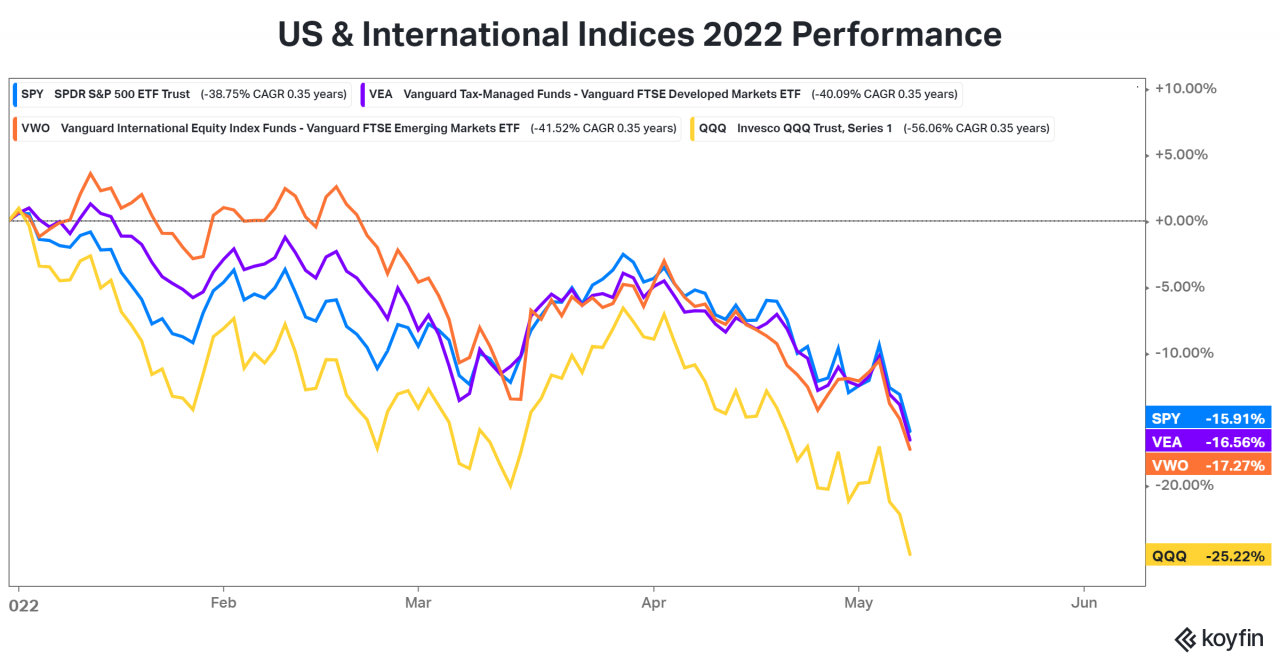

Our main chart highlights the S&P 500 making fresh year-to-date lows along with the tech-heavy Nasdaq 100 and international benchmarks like Developed Markets Ex-US and Emerging Markets. Check it out:

On the news front, there were no major releases to fault for today’s selling. Instead, this looks to be a continuation of investors digesting the Fed’s tightening decision and its implications for the economy and markets. 💡

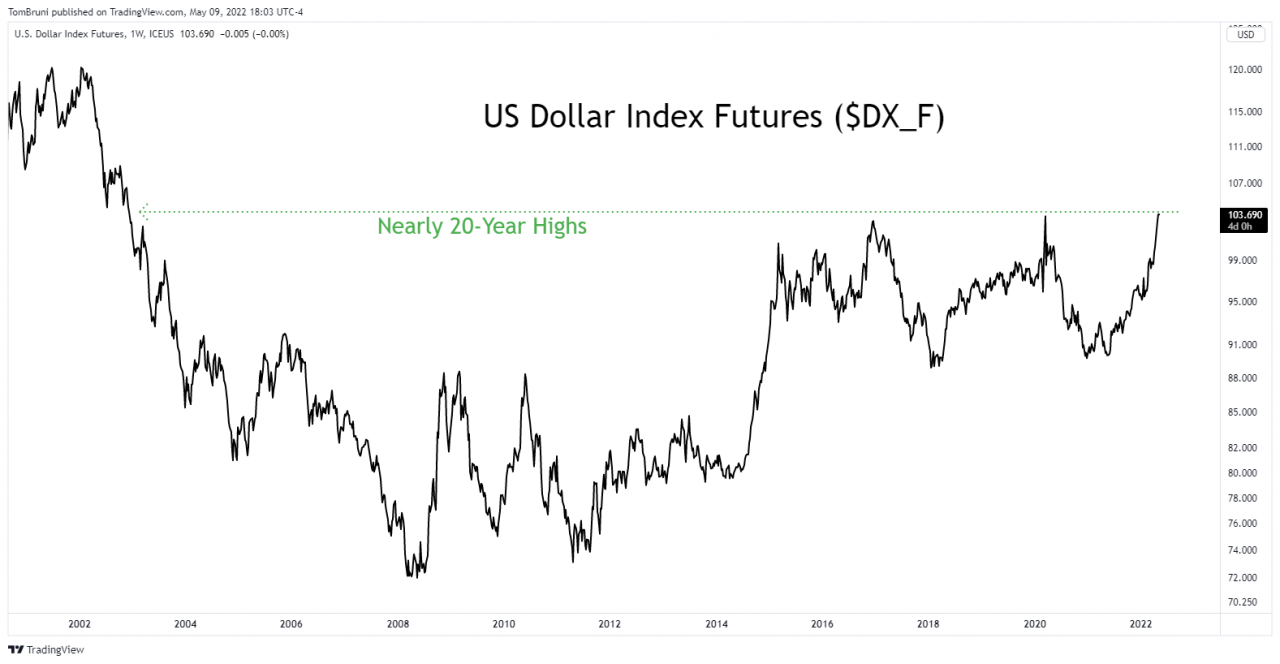

For a year, the U.S. Dollar has acted as a safe haven, and that continued with U.S. Dollar Index Futures closing at its highest levels in nearly 20 years ($103.69). What’s notably different today, however, is that there was also a bid on Treasuries, particularly at the short end of the curve, as risk assets sold off across the board.

As U.S. Interest Rates sit near 3.5-year highs, some investors may begin to consider them a tasty alternative to the dividend yields provided by larger stock market indexes and individual sectors, like REITs. 😋

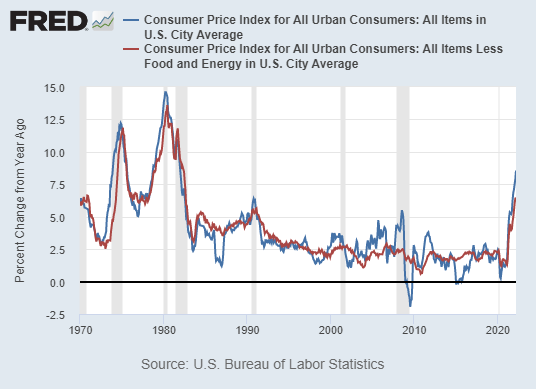

All eyes will be on Wednesday’s Consumer Price Index print, which is expected to come in at 0.2% month-over-month and 8.1% year-over-year.

With inflation at 40-year highs in the United States, it’s rightfully one of investors’ big concerns. If this week’s numbers are below expectations and interest rates start stabilizing, that could reduce some of the volatility and selling we’re seeing in equities and risk assets around the globe. 🌎

In the meantime, investors will wait for signs of life in the hardest-hit areas of the market to spur an improvement.