It was a mixed week for markets, with stocks closing near the flatline and “safe-haven” assets like gold and treasuries catching a bid. 📊

Let’s recap and prep you for the week ahead. 📝

What Happened?

⚠️ Investors took a cautious approach as the Israel-Hamas war escalated, flocking toward gold and other “safe-haven” assets. Meanwhile, some analysts cited valuation as a reason small-cap stocks are a bargain compared to their large-cap counterparts. For now, though, a lack of leadership is keeping a lid on the stock market’s progress.

🤩 This week’s Stocktwits Top 25 report showed outperformance relative to the indexes.

🔺 Producer prices rose on an annual basis for the third straight month, pushed up by energy prices. Consumer prices also popped, with shelter prices accounting for more than half of the September reading. Meanwhile, the internet collectively dunked on economist Paul Krugman for declaring the war on inflation over, “at very little cost.”

🏦 Bank stocks kicked off another round of earnings season on Friday. Collectively, they maintained a guarded tone. Executives acknowledged that the consumer is still holding up well but cautioned that higher interest rates will eventually reduce loan growth and overall credit quality.

🪟 The initial public offering (IPO) window remains somewhat open. Birkenstock was the latest high-flying name to go public, pricing at the midpoint of its valuation range. However, it did not receive much support once it hit the market, slumping on opening trade and every day since.

💊 Analysts are blaming the decline in food and beverage stocks on Ozempic and other weight-loss drugs. However, commentary from Pepsi countered that claim, with executives saying they’ve not seen any material impact on results. Plus, we explored a more likely explanation for their declines.

📰 Several other stocks made headlines, including LVMH, Delta Air Lines, Progressive, Canon, Dollar General, and Palladium (not a stock).

🔥 Several names were on the Stocktwits trending tab for most of the week, including $MANU, $AVTX, $JD, $NVOS, $TTOO, $SAVA, and $REQ.X.

Here are the closing prices:

| S&P 500 | 4,328 | +0.45% |

| Nasdaq | 13,407 | -0.18% |

| Russell 2000 | 1,720 | -1.48% |

| Dow Jones | 33,670 | +0.79% |

Bullets

Bullets From The Weekend

💉 Experts warn scaling weight loss medicines will face significant hurdles. While Novo Nordisk and its competitors are riding high on optimism around Ozempic and other obesity drugs, some experts suggest that scaling these products could be more difficult than anticipated. One of the major challenges is likely to be developing robust data on the drugs’ effectiveness on Alzheimer’s, alcohol addiction, and other diseases that would increase their market share. Getting insurance companies to pay for these “miracle drugs” is also proving challenging without long-term data backing their effectiveness. CNBC has more.

🌐 OnlyFans CEO says the company aims to “change the internet.” The company aims to do that, in part, by inverting existing business models. While the U.K.-based site is known for its adult content, it’s also testing unconventional approaches to other content, like streaming content for free while making users pay for social media content. So far, the site has accumulated over 3 million content creators and generated $1 billion in revenue ($525 million in profits) during 2022. CEO Keily Blair said the company will continue focusing on developing alternate business models for monetizing internet content and that going public is not in its current roadmap. More from Axios.

📀 DVDs are slowly going the way of the VHS tapes. For those who still enjoy content using DVDs, they’re going to have one less place to shop soon. That’s because Best Buy will reportedly end all physical media sales in-store and online sometime in early 2024. This comes shortly after Netflix ended its 25-year DVD delivery service, leaving Walmart, Target, Redbox, and Amazon as the major players. With physical product sales falling 28% YoY through the first two quarters of 2023, it’s expected retailers will continue to transition away from them and towards more innovative products. Engadget has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

Economic Calendar

It’s a quieter week on the economic data front, with investors hearing from several Fed members and getting updated housing market data. In addition to the above, check out this week’s complete list of economic releases.

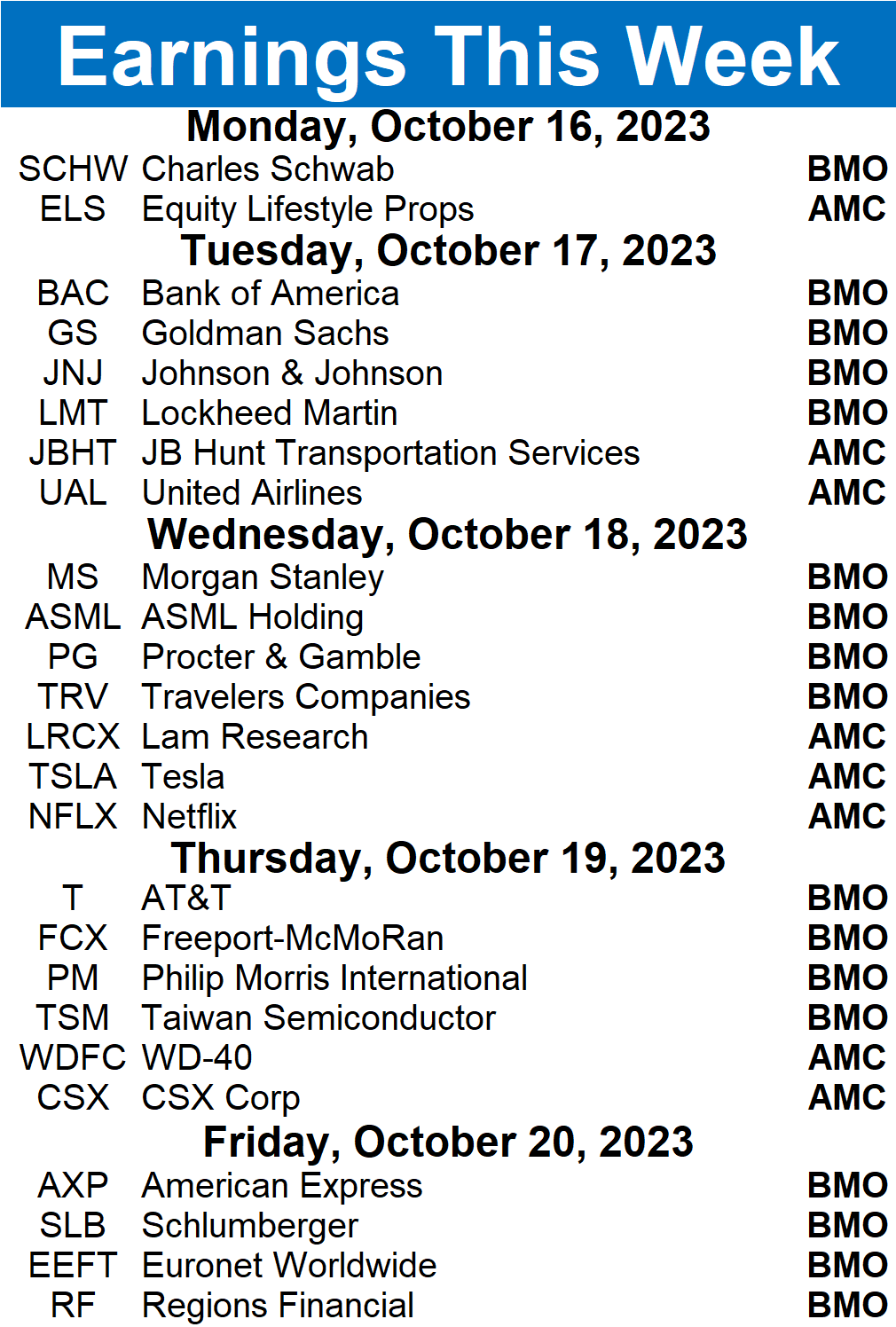

Earnings This Week

Earnings season is set to begin its slow ramp-up, as 144 companies report this week. Some tickers you may recognize are $BAC, $GS, $MS, $TSLA, $ASML, $NFLX, $TSM, $T, $AXP, $SLB, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links

Links That Don’t Suck:

📈 Find top stocks using a 3-step system—book a free 30-minute showcase with MarketSmith by IBD!*

🤔 Renting can age you faster than smoking or obesity, researchers find

😰 56% of adults feel ‘behind’ on retirement savings, survey finds. Here’s how to tell if you are

😡 Cassava implies ‘short-sellers’ to blame for leaking CUNY report alleging scientific misconduct

🚕 China gives Ehang the first industry approval for fully autonomous, passenger-carrying air taxis

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.