Volatility picked up in the stock market this week after inflation rose more than anticipated, pushing rate cut odds out further. 👀

Let’s recap and prep you for the shortened week ahead. 📝

What Happened?

🔻 The stock market indexes fell for just the second time in 2024, with the Fed’s message finally being heard after inflation’s upside surprise.

🤩 This week’s Stocktwits Top 25 report showed outperformance relative to the indexes.

⚡ It was a crazy week for semiconductor stocks, with Nvidia overtaking Amazon and Alphabet to become the fourth largest company in the world and Super Micro Computer shares jumping over $1,000. However, by the end of the week, some of the stocks looked like they put in a short-term top.

🚗 Lyft’s investor relations department screwed up their earnings release, sending the stock popping and then dropping. Despite the screwup, Lyft and Uber both had strong weeks for their own reasons, as investors bet on the ridesharing market.

💊 The biotech sector remains a fertile dealmaking ground, with investors targeting PHAT gains from small/micro-cap names as well as diversified vehicles like ETF $XBI.

📰 Several other topics made headlines, including Jumia jumping, Carl Icahn accumulating JetBlue, and why cotton could cause problems for stock investors.

🔥 Certain symbols were on the Stocktwits trending tab for most of the week, including $ROKU, $SOUN, $LUNR, $HOLO, $SHOP, and $BTC.X.

Here are the closing prices:

| S&P 500 | 5,006 | -0.42% |

| Nasdaq | 15,776 | -1.34% |

| Russell 2000 | 2,033 | +1.13% |

| Dow Jones | 38,628 | -0.11% |

Bullets

Bullets From The Weekend:

✈️ Carl Icahn snags two seats on JetBlue’s board. The activist investor accumulated a 9.91% ownership stake in the company at an average cost of $5.57 because he believes the airline is undervalued despite U.S. regulators blocking its merger with Spirit Airlines. Icahn entered into an agreement with the company to have the general counsel of Icahn Enterprises and a portfolio manager of Icahn Capital join its board of directors. CNBC has more.

🤖 AI companions are proving to be a privacy nightmare. In the age of artificial intelligence and hyper-onlineism, more and more people are turning to AI-driven companion apps to meet their need for connection. However, research from Mozilla found that many of these apps fail privacy checkups and often don’t stand by what their chatbots ask of users. Critics say the intimate nature of these relationships means that more needs to be done to protect people’s information from bad actors. More from The Verge.

📝 Reddit signs content licensing deal ahead of IPO. The social media giant has signed a contract allowing an artificial intelligence (AI) company to train its models on its platform’s content. The company has been preparing for an initial public offering sometime in 2024, so it clearly hopes the deal (worth a reported $60 million) will help bolster its financial position and prospects as it attempts to drum up investor support. The company was last valued at $10 billion in its 2021 funding round, but reports indicate its target IPO valuation could be half of that. Reuters has more.

Stocktwits Presents “Trends With Friends”

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on “Trends With Friends.”

In this week’s episode, the friends and special guest Jim O’Shaughnessy discuss:

- Artificial Intelligence: How AI impacts the stock market and fuels speculation 🔥

- Markets: The growing number of divergences pointing to a market reversal ⚠️

- Life: Parents and grandparents’ role in guiding the youth through tech advances 👴

Watch it now on YouTube and Spotify, and subscribe to catch each episode when it goes live!

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

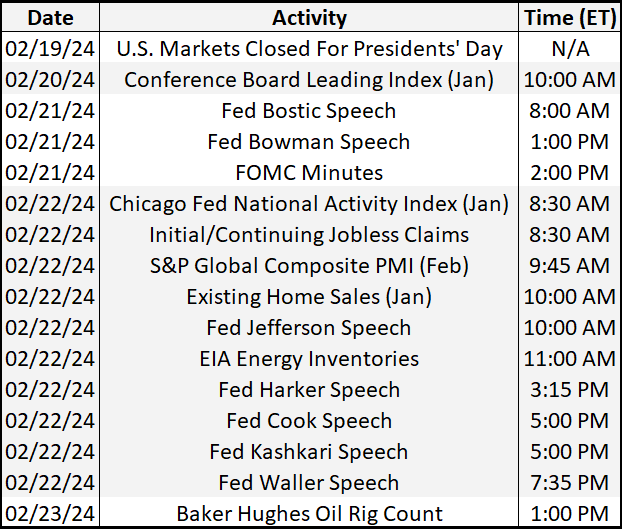

Economic Calendar

It’s a lackluster week of economic data, with Fed members scheduled to speak most of the week. In addition to the above, check out this week’s complete list of economic releases.

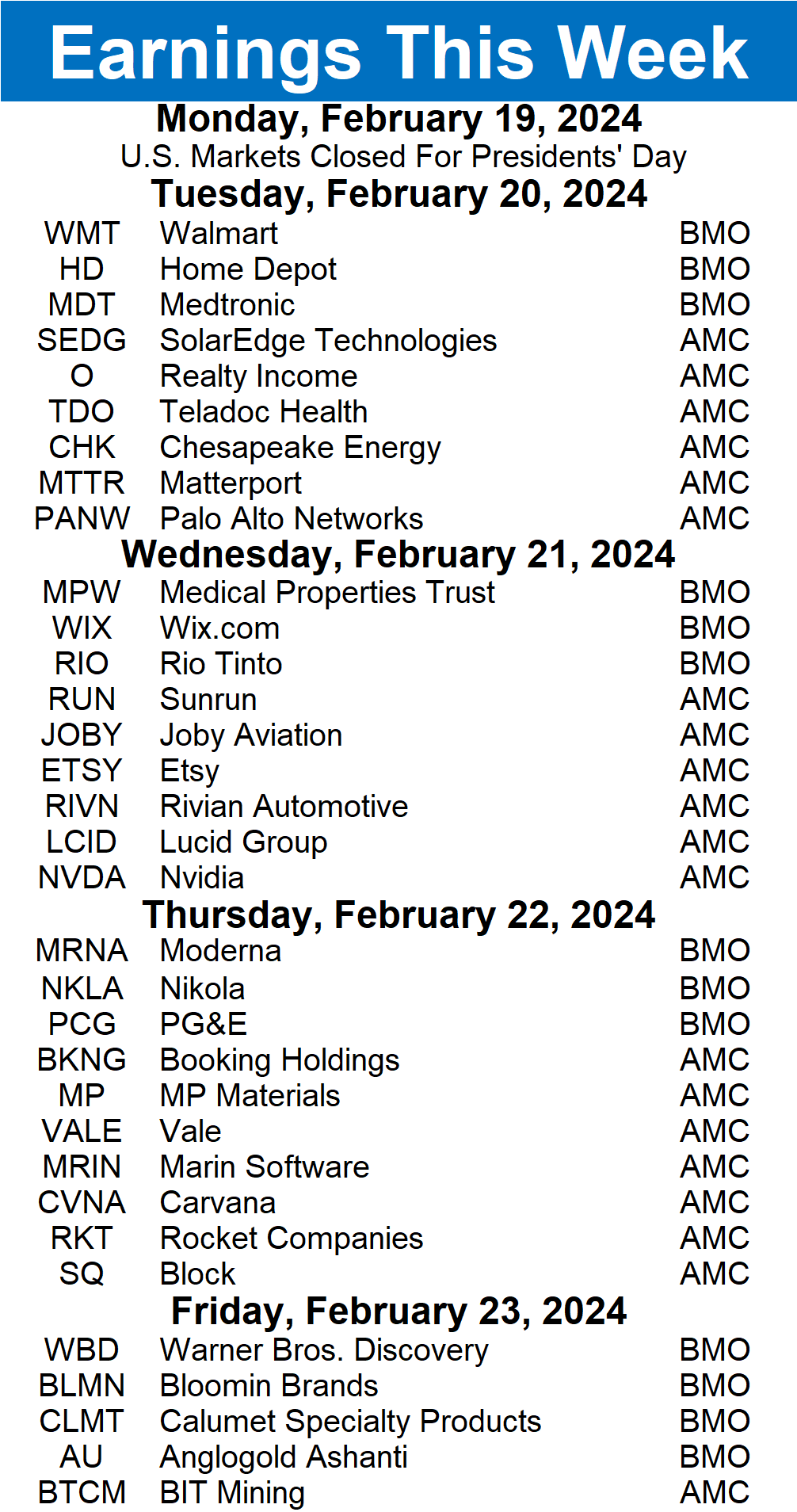

Earnings This Week

Earnings season is in full swing, with 493 total companies reporting this week. Some tickers you may recognize are $NVDA, $CVNA, $SQ, $WBD, $WMT, $HD, $RIVN, $LCID, $SEDG, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Stocktwits Spotlight:

While most of the market is focused on large and mega-cap technology stocks, other areas are alive and kicking. We’ve touched on several, including the healthcare and industrial sectors, but some investors are looking at different market-cap segments for opportunities in the strongest groups. 📊

Stocktwits user Ivanhoff shared the chart above, which shows the S&P Mid-Cap 400 ETF $MDY breaking out to its highest level in more than two years and sitting just below all-time highs.

Although investors and traders often look at the small-cap Russell 2000 index, they generally forget about the mid-caps. But with the ETF pushing towards new highs, it’s slowly getting back on everyone’s radars as they look for trade and investment ideas besides semiconductors. 🧭

We’ll certainly be keeping our eyes on it, too. In the meantime, you can follow Ivanhoff on Stocktwits for more chart analysis and insights like this! 👀

Link

Links That Don’t Suck:

👋 New features, powerful upgrades and a new name… MarketSmith becomes MarketSurge on March 4th!*

💊 FDA approves first drug to prevent severe food allergy reactions

🔋 What the U.S. can learn from Norway when it comes to EV adoption

☀️ FDA approves first cell therapy to treat aggressive forms of melanoma

📍 The 10 U.S. cities where renters’ incomes go the furthest—No. 1 is in California

🛒 Shopping online at 2 a.m.? That’s a red flag for buy now, pay later lender Affirm

🤦 Air Canada loses court case after its chatbot hallucinated fake policies to a customer

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.