Stocks and bonds both turned a corner this week, as the Federal Reserve’s decision and economic data helped spark a rally in heavily shorted stocks. 📈

Let’s recap and prep you for the week ahead. 📝

What Happened?

🐂 The market closed out a rough October, where most asset classes besides commodities ended in the negative. With that said, bulls found support in several markets and began November with their best week in several quarters. Beaten-down and heavily shorted growth stocks rallied sharply.

🤩 This week’s Stocktwits Top 25 report showed outperformance relative to the indexes.

⏯️ The Federal Reserve kept interest rates unchanged, with Chairman Jerome Powell striking an undertone that the risks of “doing too much” and “doing too little” are becoming more balanced. This week’s jobs data showed a continued cooling, but the labor market remains historically strong, buoying the U.S. economy.

📱 Apple was the latest tech giant to report, beating on most metrics but showing a fourth straight quarter of YoY revenue declines. The company’s services revenue helped offset weakness in the Greater China area, where results were flat YoY. Meanwhile, chipmaker Qualcomm’s CFO hinted that the smartphone and PC market could be nearing a bottom.

🍋 The market continues to sour on China’s recovery, with the Yum Brands vs. Yum Brands China earnings contrast highlighting the economy’s struggles.

🏘️ Real estate stocks were hit by a National Association of Realtors (NAR) lawsuit, which could shake up the residential real estate market in a big way.

📰 Several other stocks made headlines, including JetBlue, Chegg and Pinterest, ON Semiconductor, SoFi Technologies, and DraftKings.

🔥 Several names were on the Stocktwits trending tab for most of the week, including $AMC, $CRSP, $AVTX, $CCJ, $ICU, and $SOL.X.

Here are the closing prices:

| S&P 500 | 4,358 | +5.85% |

| Nasdaq | 13,478 | +6.61% |

| Russell 2000 | 1,761 | +7.56% |

| Dow Jones | 34,061 | +5.07% |

Bullets

Bullets From The Weekend

💰 The newest wedding registry trend is a “Home Fund.” With home prices at record highs and interest rates soaring, the number of couples who include “home funds” in their wedding registry has increased by 55% since 2018, to nearly a fifth of all couples. Additionally, 43% of couples reported gift funds from friends and family as one of their funding streams for a house down payment. The trend is dubbed “milestone gifting,” where instead of asking for celebratory treats, couples ask for cash to help fund the next phase of their life together. Axios has more.

🚫 South Korea to re-impose short-selling ban. The country seeks to promote a “level playing field” for retail and institutional investors by banning short-selling until at least June 2024. The ban was lifted in May 2021 for large-cap stocks in the country but has remained in place for most other stocks to prevent large foreign investors from engaging in unfair trading practices. It’s establishing a team to investigate these foreign investment banks for illegal activity and will review market activity again in June to determine if the ban should be lifted. More from Reuters.

🤖 Elon Musk debuts an AI bot to rival ChatGPT and others. The billionaire’s new artificial intelligence venture, xAI, has launched its first chatbot technology named Grok. The prototype is in its first two months of training, being made available to a select group of users before a broader release to compete with OpenAI, Inflection, Anthropic, and others in the space. According to the company, Grok is supposed to have a bit of wit, a rebellious streak, and be able to answer the “spicy questions” that other models might avoid. CNBC has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

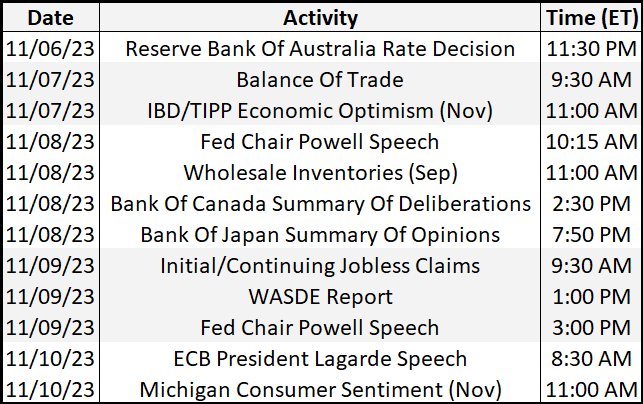

Economic Calendar

It’s a slower week on the economic data front, with Fed Chair Powell speaking several times (as well as other Fed members not listed). In addition to the above, check out this week’s complete list of economic releases.

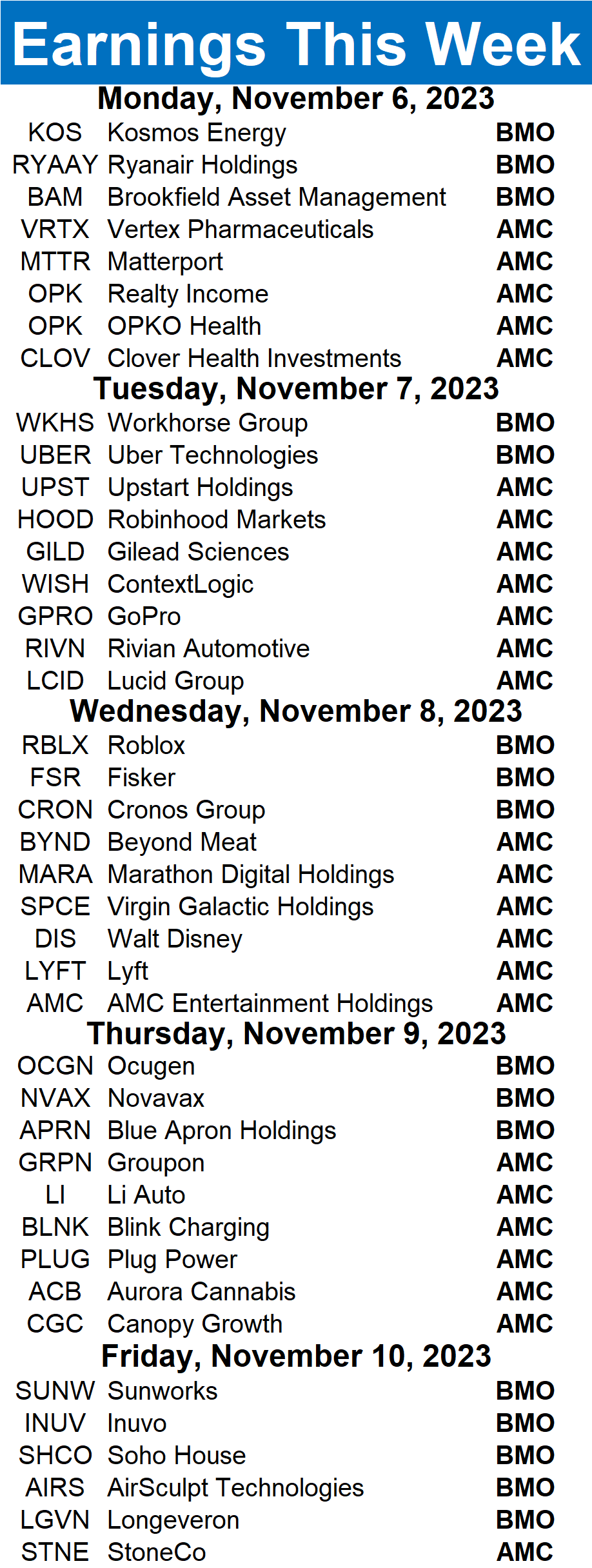

Earnings This Week

Earnings season has officially ramped up, as 1,143 companies report this week. Some tickers you may recognize are $HOOD, $UPST, $UBER, $RIVN, $RBLX, $FSR, $BYND, $AMC, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links

Links That Don’t Suck:

😮 Byju’s misses revenue projection in much-delayed financial account

💵 Berkshire Hathaway posts 40% surge in operating earnings and record cash

🤔 Two former Google engineers have a product and a plan to fix robot vacuums

🖼️ AI companies have all kinds of arguments against paying for copyrighted content

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.