It was another solid week of gains for the U.S. stock market indexes as Nvidia earnings poured fuel on the bulls’ fire. 👀

Let’s recap and prep you for the week ahead. 📝

What Happened?

📈 This week, we saw a new high in new highs, as Nvidia topped $2 trillion to become the fourth largest stock in the world by market capitalization. That helped push the S&P 500 and Nasdaq 100 to new all-time highs, while overseas, Japan’s Nikkei 225 hit its first all-time high in 34 years!

🤩 This week’s Stocktwits Top 25 report showed outperformance relative to the indexes.

🥾 In a sign of the times, the Dow Jones Industrial Average gave Walgreens the boot, replacing the struggling pharmacy retailer with tech giant Amazon. However, some were quick to point out that being kicked from the Dow has historically been a positive thing (on average).

🚀 Space exploration company Intuitive Machines took the retail investing environment by storm, rising sharply after becoming the first privately developed spacecraft to land on the lunar surface. With that said, the stock pulled back Friday after the bell on news that the Nova-C cargo moon lander didn’t “stick the landing” and is currently lying on its side.

🐂 With animal spirits alive and well, unprofitable social media giant Reddit is preparing to test the initial public offering (IPO) environment, filing its Form S-1. Bears quickly pointed out that the company has yet to make money from its operations and will likely be a bad investment, though we’ll have to wait and see.

📰 Several other topics made headlines, including Walmart betting big on advertising, cyber stocks getting clocked, renewable energy stocks lacking a charge, AT&T suffering a major outage, Carvana cruising higher, and Warner Bros. Discovery falling despite its Max streaming service turning a profit.

🔥 Certain symbols were on the Stocktwits trending tab for most of the week, including $HOLO, $BOIL, $ROOT, $OCEA, $ICU, and $JASMY.X.

Here are the closing prices:

| S&P 500 | 5,089 | +1.66% |

| Nasdaq | 15,997 | +1.40% |

| Russell 2000 | 2,017 | -0.79% |

| Dow Jones | 39,132 | +1.30% |

Bullets

Bullets From The Weekend:

🖼️ A stock exchange for art is finally in the works. The art market has been characterized for centuries by its opacity and illiquidity, but a new Liechtenstein-based stock exchange called Artex hopes to change that. The first listing, a triptych by Francis Bacon, is set to begin trading on March 8th. Artex intends to list another ten artworks this year and eventually one every other week, eventually aggregating them into a single ETF. The artworks can remain on the exchange in perpetuity, or anyone can make a takeover bid at a 20% or greater premium. Axios has more.

❌ UnitedHealth subsidiary down for the fourth day after a cyberattack. The health giant’s subsidiary, Change Healthcare’s systems are down after a “suspected nation-state-associated” actor infiltrated its IT network. While it isolated and disconnected the impacted systems once the threat was detected, it expected systems to remain down through Saturday. However, as of writing this on Sunday, there’s been no update as the downstream impacts of this continue to weigh on the nation’s healthcare system. More from CNBC.

💰 KKR nears $4 billion deal for Broadcom unit. The private equity giant is nearing a deal to buy a software business from Broadcom, with the acquisition announcement coming as soon as Monday. Broadcom is selling its so-called end-user computer unit, which it inherited as part of its $61 billion acquisition of software maker VMWare last year. EQT AB and Thoma Bravo were also interested in acquiring the unit, but it appears KKR’s bid has topped them. Yahoo Finance has more.

Your Weekend Watch

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on “Trends With Friends.”

In this week’s episode, the friends and special guest Chris Camillo discuss:

- Humanoids: Chris’ big bet on how AI will manifest in the physical world 🤖

- Markets: Apple’s fall from grace and the group’s highest-conviction trades 💰

- Health: Practical advice on embracing less in the age of overabundance 🚫

Watch it now on YouTube and Spotify, and subscribe to catch each episode when it goes live!

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

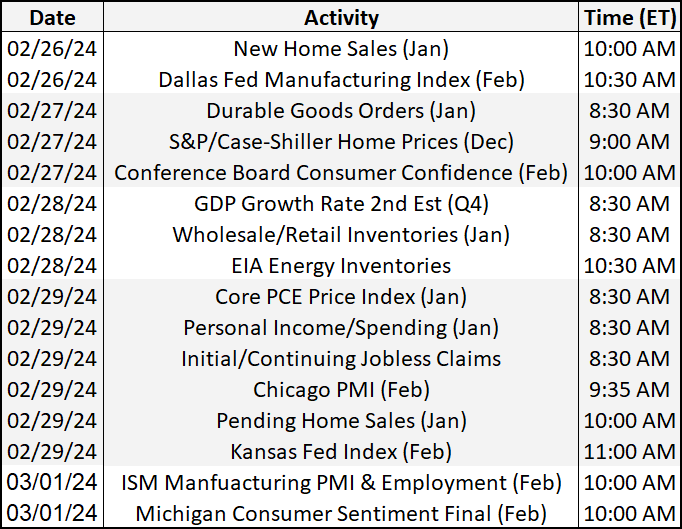

Economic Calendar

It’s a busy week of economic data, with investors focused on inflation and consumer sentiment. In addition to the above, check out this week’s complete list of economic releases.

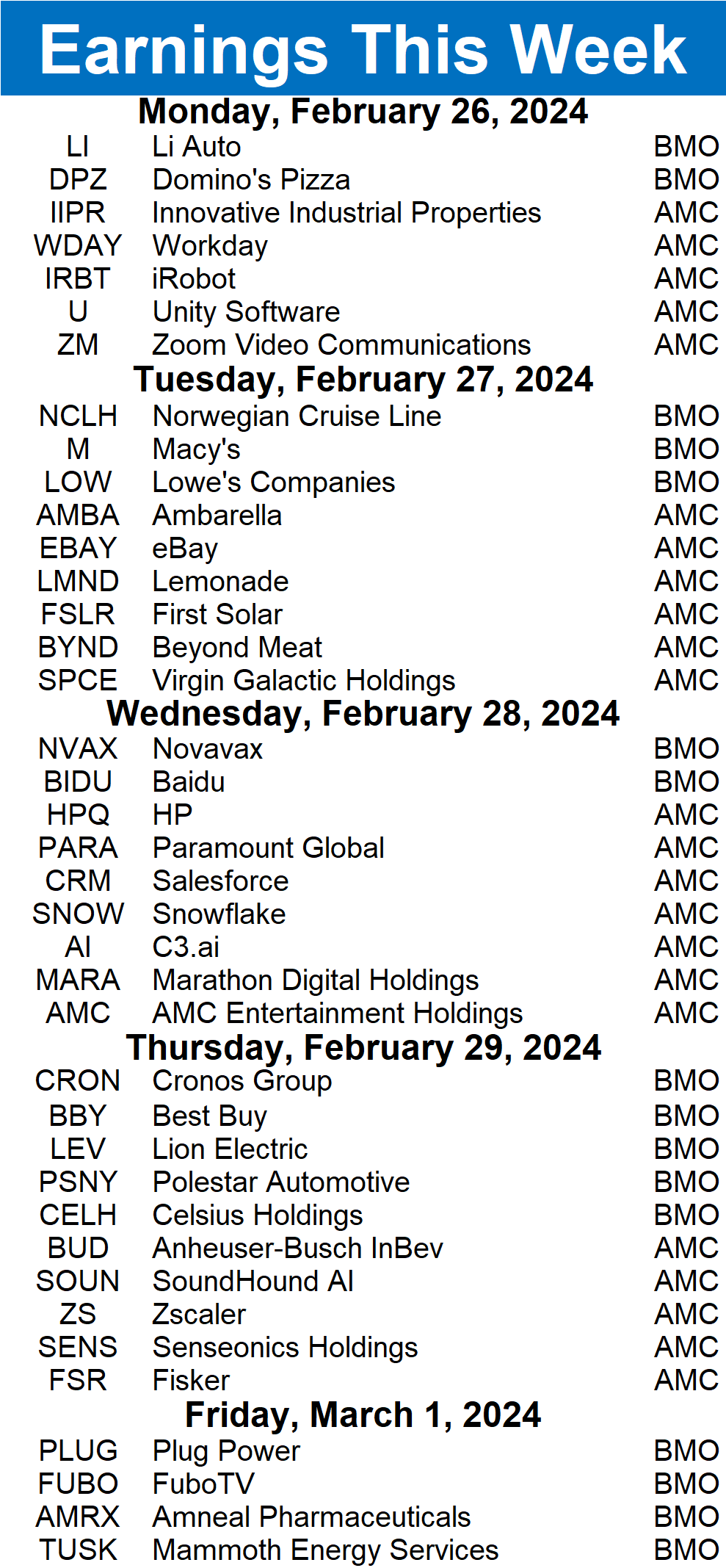

Earnings This Week

Earnings season is in full swing, with 634 total companies reporting this week. Some tickers you may recognize are $FSR, $LI, $PSNY, $PLUG, $AMC, $SPCE, $FSLR, $ZM, $AI, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Even More Great Content 👀

Stocktwits community lead Tommy Tranfo is joined by co-founder Howard Lindzon and resident chart guy Aaron Jackson every week on “Momentum Monday.”

In this week’s episode, the group discusses:

- Why Nvidia is still a buy despite its massive run 📈

- Rivian, electric vehicle stocks, and the ARK Invest disaster 🪫

- The Stocktwits community’s favorite sectors 🔥

- Top stock (and coin) picks for the week ahead 🤩

Watch it now on YouTube and subscribe to catch each episode when it goes live!

Link

Links That Don’t Suck:

💰 Save $60+ on top trading resources you won’t find elsewhere––get 8 weeks of IBD Digital for $8!*

🧑⚖️ Judge signs off on Binance’s $4.3B plea deal with U.S. prosecutors

⚠️ The dangers of parents sharing their children’s lives on social media

🗑️ H&R Block wiped out tax data of filers looking for less pricey option, FTC alleges

🤦 AT&T ‘making it right’ with $5 credit to customers after last week’s hours-long outage

📝 Warren Buffett mourns Charlie Munger, says Berkshire’s ‘eye-popping’ performance is over

🤣 A former Gizmodo writer changed his name to ‘Slackbot’ and stayed undetected for months

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.